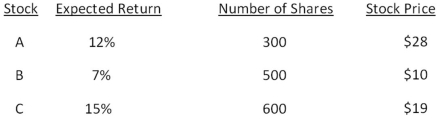

What is the expected return on this portfolio?

Definitions:

Cost of Equity

The return that investors expect for investing in a company's equity, often estimated using models like the Capital Asset Pricing Model (CAPM).

Weighted Average Cost

The combined cost of both variable and fixed goods, services, or sources of finance, weighted according to their proportions.

Bond Issues

The process of offering bonds to investors, which are debt securities constituting a loan to the issuer from the bondholder.

Cost of Debt

The effective rate that a company pays on its current debt, which can include bonds, loans, and other forms of debt, influencing its capital structure decisions.

Q6: Roger's Meat Market is considering two independent

Q22: Simulation analysis is based on assigning a

Q22: Efficient financial markets fluctuate continuously because:<br>A)the markets

Q44: Net present value:<br>A)is the best method of

Q46: If a project has a net present

Q47: Hybrid cars are touted as a "green"

Q57: Webster Electrics is offering 1,500 shares of

Q67: All else constant,which one of the following

Q76: What is the standard deviation of the

Q93: Which one of the following involves a