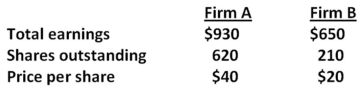

Consider the following premerger information about Firm A and Firm B:  Assume that Firm A acquires Firm B via an exchange of stock at a price of $25 for each share of B's stock.Both A and B have no debt outstanding.What will the earnings per share of Firm A be after the merger?

Assume that Firm A acquires Firm B via an exchange of stock at a price of $25 for each share of B's stock.Both A and B have no debt outstanding.What will the earnings per share of Firm A be after the merger?

Definitions:

Renovation Expense

Costs incurred in the process of improving or updating a property, structure, or equipment to increase its value.

Working Capital

The difference between a company's current assets and current liabilities, indicating the amount of liquid assets available for day-to-day operations.

Incremental Net Income

Net income resulting from a particular action or decision, calculated as the difference in total net income if the action is taken versus if it is not.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on income or profits.

Q2: The most acceptable method of evaluating the

Q29: Old Country Productions requires skilled furniture finishers

Q41: The EOQ model is designed to minimize:<br>A)production

Q59: Your firm has total assets of $4,900,fixed

Q63: Jeff owns a $1,000 face value bond.He

Q67: The common stock of Westover Foods is

Q78: Which one of the following statements concerning

Q79: Which one of the following can be

Q81: At the beginning of the year,a firm

Q95: It is commonly recommended that the managers