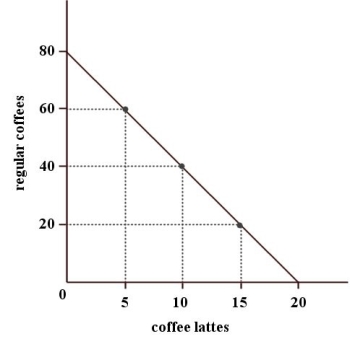

Madeleine allows herself $100 per month for purchasing coffee.The diagram below illustrates the choices available to her in each month.  FIGURE 1-3

FIGURE 1-3

-Refer to Figure 1-3.For Madeleine,the opportunity cost of one regular coffee is

Definitions:

Separately Stated Items

Items on a partnership or S corporation tax return that are reported separately from ordinary income to ensure proper tax treatment at the partner or shareholder level.

Ordinary Items

Refer to the common income or expenses that affect the net income of a business, as opposed to extraordinary items which are unusual or infrequent.

Partnership Income

The share of profits or losses from a partnership that are allocated to the partners for tax purposes, based on the partnership agreement.

Adjusted Basis

Adjusted Basis is the value of an asset for tax purposes, adjusted for factors like depreciation or improvement costs, used to determine the gain or loss on the asset's sale.

Q1: The short interest on Blue Water Cruisers

Q7: What was the prior day's closing price

Q12: With a downward-sloping straight-line demand curve,price elasticity

Q53: Refer to Figure 2-4.The functional relation shown

Q55: Celsius stock had year end prices of

Q61: The relative price of a good<br>A)is always

Q70: Steve placed a limit order to sell

Q100: Refer to Figure 2-3.On curve A,the maximum

Q115: Refer to Table 3-2.At a price of

Q138: Refer to Table 3-4.Suppose the price of