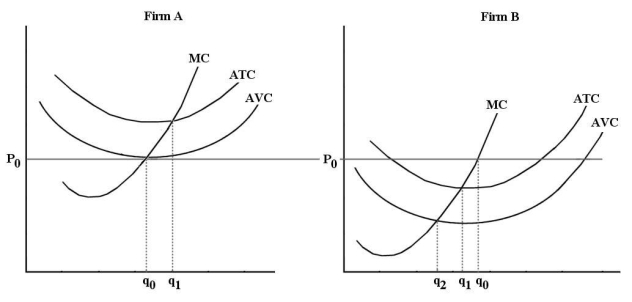

Consider the following cost curves for two perfectly competitive firms,A and B.  FIGURE 9-3

FIGURE 9-3

-Refer to Figure 9-3.Firms A and B are in the same industry.Choose the statement that best describes the situation facing the two firms.

Definitions:

Environmental Influences

Environmental influences involve external factors and conditions that impact an individual's physical, psychological, and social development.

Sensitive Period

A point in development when organisms are particularly susceptible to certain kinds of stimuli in their environments, but the absence of those stimuli does not always produce irreversible consequences.

Synaptic Pruning

The process during brain development where extra neurons and synaptic connections are eliminated to increase the efficiency of neuronal transmissions.

Neurons

Specialized cells of the nervous system that transmit signals throughout the body; key components in the function of the brain, spinal cord, and peripheral nerves.

Q2: Refer to Figure 12-7.If this firm were

Q9: A monopoly is distinguished from a firm

Q14: Refer to Table 10-2,and suppose that the

Q43: Refer to Figure 12-7.Suppose this firm is

Q48: Consider the following characteristics of a particular

Q49: Consider a perfectly competitive firm that is

Q56: Refer to Table 13-3.The marginal product of

Q86: In the 1890s nearly 50 percent of

Q95: Refer to Figure 11-1.What price will this

Q144: Suppose a firm with the usual U-shaped