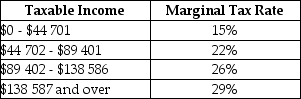

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $70 000,how much federal tax would be due?

Definitions:

FAB Formula

A sales technique focusing on the features, advantages, and benefits of a product, designed to present its value proposition effectively.

Customer Profile

A detailed description of the characteristics, behaviors, and demographics of a business's typical customers.

Analogy

A comparison between two different situations that have something in common.

Simile

A figure of speech that makes a comparison between two different things using "like" or "as" to create a vivid description.

Q3: The concept of "institution building" is becoming

Q5: The concept of vertical equity is derived

Q21: The "informal defence" of free markets includes

Q21: Consider the circular flow of income and

Q36: Evidence suggests that some of the observed

Q49: In a free-market economy,<br>A)temporary shortages and surpluses

Q89: Refer to Table 20-5.If 2015 is the

Q106: A firm can finance its purchase of

Q119: Consider a simple macro model with demand-determined

Q124: Consider a consumption function of the following