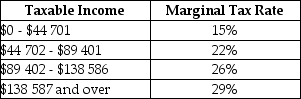

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much total federal tax would be due?

Definitions:

Miliann Kang

A researcher and author known for her work on the intersection of gender, race, and the service economy.

Nail Salons

Businesses specializing in the grooming, shaping, and coloring of fingernails and toenails, offering services like manicures and pedicures.

Second Shift

The phenomenon where individuals, often women, work a paid job outside the home and then return to unpaid domestic responsibilities.

Poverty Rates

The ratio or percentage of the population living below the poverty line, reflecting the portion of the community considered to be experiencing economic hardship.

Q22: Which of the following is an equivalent

Q40: Choose the best reason for a rightward

Q51: Which of the following statements about the

Q61: The group that tends to be most

Q63: Refer to Table 19-1 What is the

Q64: Suppose that a country's population is 30

Q71: Suppose aggregate output is demand-determined.If the business

Q75: Refer to Figure 16-3.Assume there are two

Q87: Consider the economy's downward-sloping demand for investment

Q94: The unemployment rate will understate the true