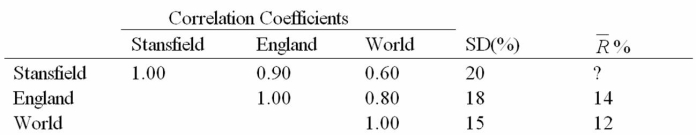

Suppose that the British stock market is segmented from the rest of the world.Using the CAPM and a risk-free rate of 5%,estimate the equity cost of capital for Stansfield.

Definitions:

Option Values

The premium or price of an options contract, determined by factors including the underlying asset's price, strike price, and expiration date.

European Put

A type of put option that can only be exercised at its expiration date, not before.

American Put

An option contract giving the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a predetermined price before or on a specified date.

Real Option

The choice available to managers regarding business investments, such as expanding, deferring, or abandoning a project, based on changing conditions.

Q17: Assuming that the interaffiliate cash flows are

Q19: What is the levered after-tax incremental cash

Q21: A major risk faced by a swap

Q22: NA <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6077/.jpg" alt="NA acts

Q66: Company X wants to borrow $10,000,000 floating

Q71: The Eximbank helps U.S.exporters develop and expand

Q74: Emerald Energy is an oil exploration and

Q78: Examples of operational risk include<br>A)the unexpected imposition

Q91: The "Sharpe performance measure" (SHP)is<br>A)a "risk-adjusted" performance

Q98: If the exporter's opportunity cost of capital