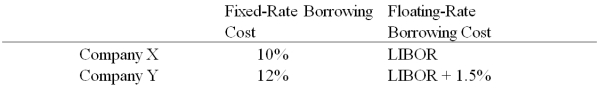

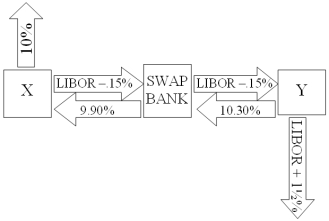

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Cognitive Process

The mental activities related to thinking, understanding, learning, and remembering.

Reacting

The process of responding to stimuli or events in the environment.

Learned Helplessness

A condition resulting from the belief that one has no control over their environment, often leading to decreased motivation and depression.

Unsolvable Problems

Issues or challenges that cannot be resolved or fixed, often due to their inherent complexity or constraints.

Q1: The Paris Bourse was traditionally a call

Q8: What is the dollar-denominated IRR of this

Q17: FASB 8<br>A)required taking foreign exchange gains or

Q21: In recent years,the U.S.dollar has depreciated substantially

Q33: Find the value of a three-year

Q41: The source of translation exposure<br>A)is a mismatch

Q46: A "specialist"<br>A)makes a market by holding an

Q57: The formula for beta is:<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2453/.jpg"

Q75: A type of noncontinuous exchange trading system

Q89: Many of the larger emerging equity markets