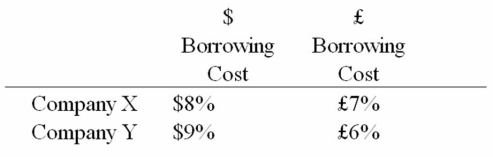

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year.The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00*(1.08) /£1.00*(1.06) = $2.0377/£1.Their external borrowing opportunities are:

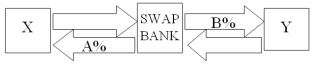

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Safety Committee

A group within an organization responsible for promoting health and safety in the workplace, often by identifying risks and proposing measures to reduce them.

Safety Officer

An individual responsible for ensuring workplace safety, making sure all regulations and policies related to health and safety are followed.

Unsafe Work

Conditions or practices in the workplace that significantly increase the risk of injury, illness, or death to employees.

Limited Right

A specific legal entitlement or permission that is restricted by terms or conditions.

Q7: From the perspective of the U.S.firm that

Q13: Assume that you have invested $100,000 in

Q21: Which of the following statements is false?<br>A)Most

Q36: Countries may welcome Greenfield investments,<br>A)as they are

Q36: Calculate the euro-based return an Italian investor

Q58: The U.S.IRS allows transfer prices to be

Q69: On the Paris bourse,shares of Avionelle trade

Q81: With regard to dual-currency bonds versus comparable

Q91: A major risk faced by a swap

Q94: In any year,the Eurobond segment of the