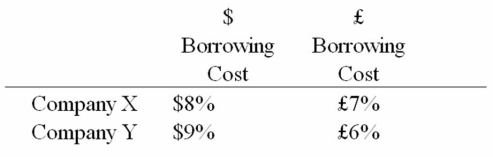

Company X wants to borrow $10,000,000 floating for 1 year; company Y wants to borrow £5,000,000 fixed for 1 year.The spot exchange rate is $2 = £1 and IRP calculates the one-year forward rate as $2.00*(1.08) /£1.00*(1.06) = $2.0377/£1.Their external borrowing opportunities are:

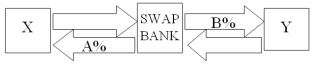

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Persian Gulf War

A conflict between Iraq and a coalition of countries led by the United States in 1990-1991, triggered by Iraq's invasion of Kuwait.

Presidential Election

The process by which a president is selected in a country, often involving a direct vote by the electorate or a vote by an electoral college following a national election.

Bush Administration

The executive period of George W. Bush, the 43rd President of the United States, which spanned from 2001 to 2009, marked by events such as the September 11 attacks and the initiation of the Iraq War.

Downsizing

The process of reducing the number of employees within an organization typically to cut costs and improve efficiency.

Q11: You are a bank and your customer

Q33: Suppose that the swap that you proposed

Q36: The major legislation controlling the operation of

Q57: Global bond issues<br>A)can save U.S.issuers 20 basis

Q57: In a study of the effect of

Q61: For a firm that has both

Q66: According to the monetary/nonmonetary method,monetary balance sheet

Q76: Since fixed assets and inventory are usually

Q79: Amortizing currency swaps<br>A)the debt service exchanges decrease

Q79: Under which accounting method are most income