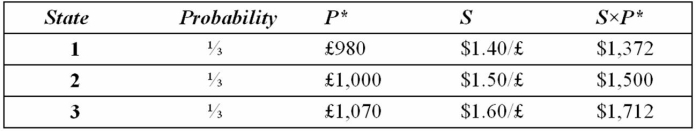

Suppose a U.S.firm has an asset in Britain whose local currency price is random.For simplicity,suppose there are only three states of the world and each state is equally likely to occur.The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined,depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Cognitive Load

The total amount of mental effort being used in the working memory, influenced by the complexity and number of tasks being performed.

Conversation Perspective

An approach or viewpoint regarding how conversations unfold, focusing on the structure, purpose, and dynamics of dialogue.

Classic Study

Refers to a well-established and widely recognized research study that has made a significant contribution to its field.

Actor-Observer Effect

A bias in attribution where individuals attribute their own behaviors to situational factors but others' behaviors to personal characteristics.

Q19: Find the value today of a

Q34: USING RISK NEUTRAL VALUATION (i.e.the binomial option

Q37: Which of the lines is a graph

Q44: Which investment is likely to be the

Q53: In any given year,rightly 80 percent of

Q68: Why would a U.S.bank open a foreign

Q72: Some commodities never enter into international trade.Examples

Q76: The dollar-euro exchange rate is $1.25 =

Q88: There is (at least)one profitable arbitrage at

Q95: Calculate the current €/£ spot exchange rate.