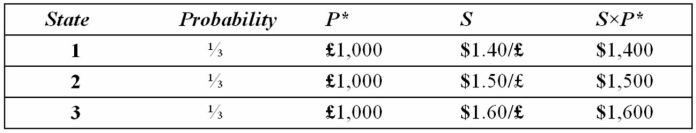

Suppose a U.S.firm has an asset in Britain whose local currency price is random.For simplicity,suppose there are only three states of the world and each state is equally likely to occur.The future local currency price of this British asset (P*) as well as the future exchange rate (S) will be determined,depending on the realized state of the world.  Which of the following statements is most correct?

Which of the following statements is most correct?

Definitions:

Waste Management

The collection, transport, processing, recycling or disposal, and monitoring of waste materials to minimize its effect on health, the environment, or aesthetics.

Delivery Speed

The rate at which a company can complete a customer's order and deliver the finished product or service.

Mode of Shipment

The method or form of transporting goods from one place to another, including by sea, air, rail, or road.

Holding Cost

The expenses associated with storing inventory that is not being sold or used in the immediate future, including warehousing, insurance, and opportunity costs.

Q29: Find the foreign currency gain or loss

Q29: A Japanese IMPORTER has a €1,000,000 PAYABLE

Q40: Which of the above statements pertain to

Q54: Come up with a swap (principal +

Q63: Managerial entrenchment efforts are clear signs of

Q64: A bank may establish a multinational operation

Q66: Suppose the futures price is below the

Q77: One enduring truth of banking is that<br>A)for

Q77: A currency dealer has good credit and

Q78: If you had €1,000,000 and traded it