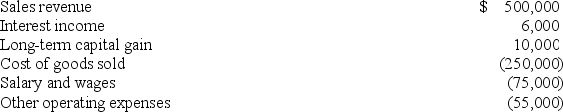

Waters Corporation is an S corporation with two equal shareholders,Mia Jones and David Kerns.This year,Waters recorded the following items of income and expense:

Waters distributed $25,000 to each of its shareholders during the year.Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year.Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Definitions:

Enabling Statutes

Laws that provide the legal framework and authority for government agencies or bodies to implement regulations and actions.

Administrative Statutes

Laws established by government agencies that detail how the agencies are to administer and enforce the laws passed by the legislature.

Federal Administration Statutes

refers to laws enacted by the federal government that govern the organization, functions, and actions of federal agencies and administrative bodies.

Federal Administrative Law Judges

Officials who preside over hearings and make decisions on disputes within federal agencies, operating under administrative law.

Q7: Money Market securities are characterised by _.<br>I.

Q9: Gabriel operates his business as a sole

Q9: An investor's degree of risk aversion will

Q14: Perry is a partner in a calendar

Q27: Lincoln Corporation,which has a 34% marginal tax

Q30: Government Q imposes a net income tax

Q39: Corporations with taxable incomes in excess of

Q53: Fundamental analysis is likely to yield best

Q56: You invest $1000 in a complete portfolio.

Q64: Orchid Inc.,a U.S.multinational with a 34% marginal