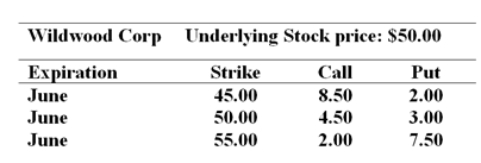

You are cautiously bullish on the common share of the Wildwood Corporation over the next several months. The current price of the share is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:  Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Definitions:

Board of Directors

A group of individuals elected by shareholders to oversee the management and make major decisions for a company.

Preferred Stock

A class of ownership in a corporation with a fixed dividend that must be paid out before dividends to common stockholders and which typically does not have voting rights.

Ownership Interest

Refers to the rights and stake a person holds in a particular asset or business, often entailing voting rights and a share in the profits.

Preferred Stock

A class of share ownership in a corporation that has a higher claim on assets and earnings than common stock, often with fixed dividends.

Q6: The average returns, standard deviations and betas

Q12: Which share is likely to further reduce

Q15: The ABS company has a capital base

Q21: What combination of puts and calls can

Q28: An American put option gives its holder

Q35: If you are going to earn abnormal

Q38: You buy a call option on Summit

Q41: Margin requirements for futures contracts can be

Q48: A firm has a share price of

Q59: The following trend equation is for a