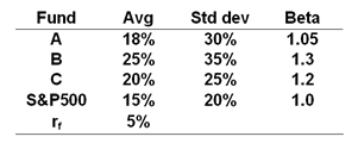

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?

Definitions:

Fixed Cost

Financial obligations that are static and do not vary with production levels or sales numbers, such as rent, salary payments, and insurance fees.

Activity Level

A measure of the volume of production or operations, often used in cost accounting to allocate variable and fixed costs appropriately.

Mixed Cost

A cost that contains both variable and fixed cost elements, making its total expense vary with changes in the level of output.

Fixed Cost

Expenses that do not fluctuate with changes in production volume, staying constant even as production levels vary.

Q11: Which of the following investment style could

Q14: Use the following cash flow data of

Q15: A one dollar increase in a share's

Q25: An increase in a bond's yield to

Q30: Autocorrelation is measured by the trend component

Q37: Interest rate swaps involve the exchange of

Q57: If the economy is going into a

Q60: In the Black-Scholes model as the share's

Q62: The national sales manager for "I colored

Q68: The chi-square test statistic used in a