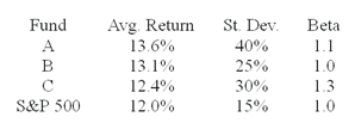

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

Definitions:

Real GDP

The market value of all final goods and services produced within a country in a given period, adjusted for inflation.

Recessions

Phases of momentary economic slump that lead to a reduction in trading and industrial activities, frequently identified by declining GDP in two successive quarters.

Aggregate Demand

The total demand for all goods and services in an economy at a given general price level and in a given time period.

Aggregate Supply

The aggregate output of goods and services that companies in a national economy aim to market within a given timeframe.

Q1: You have a 15 year maturity 4%

Q9: Suppose that the pre-tax holding period returns

Q21: A high water mark is a limiting

Q41: The take-home pay of an employee working

Q42: When bonds sell above par, what is

Q46: The Paasche method uses the amounts consumed

Q53: Assignable causes are usually large in number

Q58: An index of 239.2 represents a 239.2%

Q62: For the third quarter,the sales are 2,500

Q73: Consider a three-year moving average. The weights