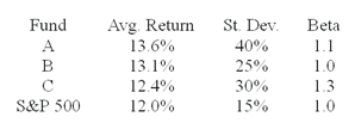

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

Definitions:

Filibusters

A political strategy where members of a legislative body extend debate to delay or block a vote on proposed legislation.

U.S. Neutrality Act

Refers specifically to any of the individual acts within the series of Neutrality Acts passed by the United States in the 1930s to avoid involvement in external conflicts, notably in the lead-up to World War II.

Mexico

A country located in the southern portion of North America, known for its rich cultural heritage, history, and as the former center of the Aztec Empire.

Spanish

A Romance language originating in the Castile region of Spain and now the world's second most spoken native language, with a sprawling influence in the Americas and parts of Africa.

Q26: The following are the ratings (0 to

Q31: What is our decision for a goodness-of-fit

Q35: Which of the following statements about causes

Q36: What was the manager's over- or under-performance

Q37: Supply-side economics tends to focus on _.<br>A)government

Q39: Everything else equal, an increase in the

Q44: In the Kruskal-Wallis test,the degrees of freedom

Q48: My pension plan will pay me a

Q49: Besides a payoff table,the information for decision

Q57: Nonparametric tests require no assumptions about the