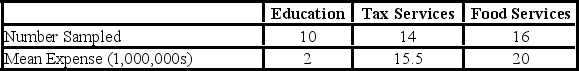

A random sample of 40 companies with assets over $10 million was surveyed and asked to indicate their industry and annual computer technology expense. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The mean square error (MSE) was 195. The following table summarized the results:  Based on the comparison between the mean annual computer technology expense for companies in the tax service and food service industries,the 95% confidence interval shows an interval of −5.85 to 14.85 for the difference. This result indicates that ________.

Based on the comparison between the mean annual computer technology expense for companies in the tax service and food service industries,the 95% confidence interval shows an interval of −5.85 to 14.85 for the difference. This result indicates that ________.

Definitions:

External Secondary Data

External secondary data refers to data that was collected by someone else outside of the organization and is available for businesses to use for research purposes.

External Secondary Data

Information collected by someone other than the user, available from outside sources such as governments, institutions, and organizations.

Economic Census

A comprehensive survey conducted by a government that collects information about the economic activities of businesses and industries within its jurisdiction.

Secondary Data

Data that was collected by someone else for a different purpose, but is being utilized for another research or analysis.

Q7: Analysis of variance is used to _.<br>A)compare

Q8: Suppose we select every fifth invoice in

Q18: The trend forecast equation is <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2636/.jpg"

Q25: A machine is set to fill the

Q25: A national manufacturer of ball bearings is

Q53: If an ANOVA test is conducted and

Q59: Which value of r indicates a stronger

Q62: For the third quarter,the sales are 2,500

Q70: A sales manager for an advertising agency

Q73: The probability of rolling a 3 or