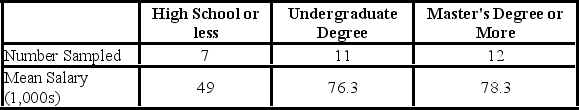

A random sample of 30 executives from companies with assets over $1 million was selected and asked for their annual income and level of education. The ANOVA comparing the average income among three levels of education rejected the null hypothesis. The mean square error (MSE) was 243.7. The following table summarized the results:  When comparing the mean annual incomes for executives with undergraduate and master's degrees or more,which of the following 95% confidence interval can be constructed?

When comparing the mean annual incomes for executives with undergraduate and master's degrees or more,which of the following 95% confidence interval can be constructed?

Definitions:

Debt Ceiling

The maximum amount of money the government is authorized to borrow without seeking approval from Congress.

Chapter 12

A chapter of the Bankruptcy Code specifically designed to address the financial restructuring of family farmers and fishermen.

Farmers

Individuals or entities engaged in the act of agriculture, growing crops and/or raising animals.

Unsecured Debts

Debts that are not backed by an asset or collateral, increasing the risk for lenders if the borrower defaults.

Q3: In multiple regression analysis,an F-statistic is used

Q4: Data for selected vegetables purchased at wholesale

Q6: If the null hypothesis is false and

Q22: A researcher is studying the effect of

Q26: A confidence interval for a population mean

Q26: When all the items in a population

Q55: Accounting procedures allow a business to evaluate

Q63: Customers of the Key Refining Company charge

Q77: Twenty-five college seniors were given two brands

Q82: In regression analysis,error is defined as (