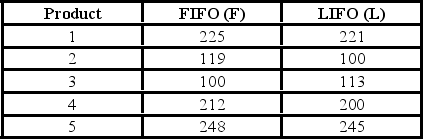

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Payable On Demand

A financial agreement or instrument that requires payment when requested by the holder.

Unconditional Promise

A commitment made without any stipulations or requirements for its fulfillment.

Relative Permanence

The quality of a negotiable instrument that ensures its longevity.

Signature

A person's handwritten mark or its digital equivalent used to signify agreement, consent, or identification.

Q9: What is a null hypothesis for a

Q12: The results of a mathematics placement exam

Q17: A stem-and-leaf diagram shows the actual data

Q30: A group of normal distributions can have

Q36: An electronics retailer believes that,at most,40% of

Q37: The standard normal distribution is a special

Q49: A sample of 100 students is selected

Q60: A sample of 100 is selected from

Q61: The chi-square statistic _.<br>A)is greater than or

Q62: The use of the chi-square statistic would