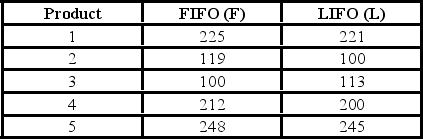

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Biologically Predisposed

Having an innate tendency or susceptibility to certain conditions, behaviors, or responses based on genetic factors.

Offspring

The children or young born to a person, animal, or plant.

Gender-typed Mates

The preference for choosing partners who conform to traditional gender roles and behaviors.

Gender Inequality

A social condition marked by unequal treatment or perception of individuals based on their gender.

Q9: In an ANOVA table for a multiple

Q9: A company is researching the effectiveness of

Q21: What is the test statistic for Spearman's

Q26: Some normal probability distributions are positively skewed.

Q26: Define the level of significance.<br>A)It is the

Q33: The variance of a probability distribution is

Q47: If we are testing for the difference

Q52: A survey of property owners' opinions about

Q62: A large department store examined a sample

Q79: Each salesperson in a large department store