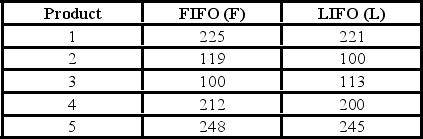

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  If you use the 5% level of significance,what is the critical t-value?

If you use the 5% level of significance,what is the critical t-value?

Definitions:

Short-Term Stock Investments

Investments in stock intended to be held for a short duration, typically less than one year, for earning a quick profit.

Fair Value

The estimated market value of an asset or liability, based on current prices in an active market.

Stock Market

A public market for buying and selling equity securities and derivatives of companies, facilitating capital exchange between investors.

Trading Securities

Financial instruments that are bought and sold for the purpose of generating profit from short-term price movements.

Q6: Which shape describes a Poisson distribution?<br>A)Positively skewed<br>B)Negatively

Q18: The null hypothesis for an ANOVA analysis

Q20: University officials say that at least 70%

Q21: What is the test statistic for Spearman's

Q25: A sample of 25 is selected from

Q46: For a binomial distribution,the mean is 4.0

Q56: The least squares technique minimizes the sum

Q69: The strength of the correlation between two

Q82: In regression analysis,error is defined as (

Q91: A survey of property owners' opinions about