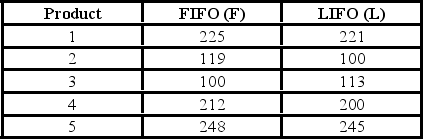

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the value of calculated t?

What is the value of calculated t?

Definitions:

Market Value

The current price at which an asset or service can be bought or sold in the open market, subject to supply and demand.

Reciprocal Services Method

A method used in cost accounting to allocate costs between interdependent departments, acknowledging mutual services they provide to each other.

Support Department Costs

The expenses associated with departments that do not directly produce goods or services but are necessary for the operation of the business, such as HR and IT departments.

Total Janitorial Department Cost

The complete expenses associated with maintaining and cleaning a facility, attributed to the janitorial department.

Q11: The mean annual incomes of certified welders

Q15: Which symbol represents a test statistic used

Q16: If all the plots on a scatter

Q19: Some important uses of the chi-square include

Q22: Which is true for a binomial distribution?<br>A)There

Q29: In a multiple regression equation with three

Q53: If an ANOVA test is conducted and

Q73: Based on the Nielsen ratings,the local CBS

Q85: In a market test of a new

Q99: If the decision is to reject the