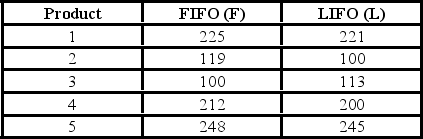

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. Based on the following results,does the LIFO method result in a lower cost of inventory than the FIFO method?  This example is what type of test?

This example is what type of test?

Definitions:

Optimal Way

The most desirable or effective method to achieve a specific goal or result.

Privately Owned Resources

Refers to assets or property owned by individuals or corporations rather than by the government or the public.

Bad Apple Effect

The tendency for one person's negative behavior to corrupt a group's dynamics or moral.

Social Loafer

An individual who contributes less effort to a collaborative task when part of a group than when working alone.

Q12: The results of a mathematics placement exam

Q17: What statement do we make that determines

Q28: In the regression equation,what does the letter

Q30: The size of the sampling error is

Q39: A study of interior designers' opinions with

Q42: This nonparametric test requires at least ordinal

Q46: The joint probability of two independent events,A

Q55: In an illustration of a normal probability

Q58: The Spearman coefficient of rank correlation is

Q74: It is claimed that in a bushel