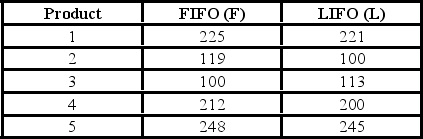

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. Based on the following results,does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Indirect Ownership Interests

Refers to a situation where an entity owns an interest in another entity through an intermediary rather than directly.

Tiered Corporate Group

A hierarchical structure where a parent company controls subsidiary companies, which in turn may control their own subsidiaries, creating multiple levels of entity relationships.

Control

The power to govern the financial and operating policies of an entity so as to obtain benefits from its activities, often through ownership of a majority of voting rights.

Sequential Consolidation Method

A process of combining financial statements of a parent company and its subsidiaries one at a time in a specific sequence.

Q12: A box plot graphically shows the 10th

Q14: A hypothesis regarding the weight of newborn

Q20: University officials say that at least 70%

Q22: A hypothesis regarding the weight of newborn

Q42: This nonparametric test requires at least ordinal

Q44: An analysis of the grades on the

Q48: When we use a confidence interval to

Q50: If A and B are mutually exclusive

Q53: The complement rule states that the probability

Q79: To test if an observed frequency distribution