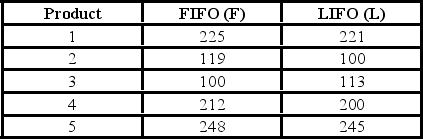

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. We would like to determine if the LIFO method results in a lower cost of inventory than the FIFO method.  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Generational Differences

Generational differences refer to the distinct social, cultural, and political attitudes that separate various cohorts, typically influenced by the major events and technological changes occurring in their formative years.

Agents of Socialization

Refers to the individuals, groups, and institutions that play a significant role in integrating an individual into society by teaching social norms, values, and skills.

Culturally Appropriate

Refers to actions or approaches that are respectful of and relevant to the cultures and values of a particular group or community.

Flexible Self

A concept describing individuals who easily adapt their identity and roles to various social situations and expectations.

Q20: A coin is tossed four times. The

Q37: If two dependent samples of size 20

Q39: The 50th percentile of a distribution is

Q40: A random sample of 30 executives from

Q41: In multiple regression analysis,before testing the significance

Q43: What can we conclude if the global

Q44: Which of the following statements regarding the

Q47: The time to fly between New York

Q50: A listing of all possible outcomes of

Q73: The mean or expected value for a