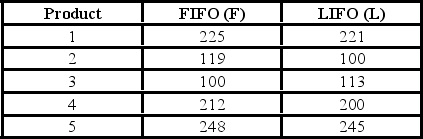

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (last in first out) or FIFO (first in first out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference,they computed FIFO − LIFO for each product. Based on the following results,does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

Definitions:

Units-of-Production Method

A depreciation method where the expense is based on the asset's usage, output, or units produced, rather than time.

Straight-Line Method

A method of calculating depreciation by evenly allocating the cost of an asset over its useful life.

Capital Lease

A lease agreement that is recorded as an asset on a lessee's balance sheet, signifying that the lessee has substantially all the risks and rewards of ownership.

Delivery Truck

A vehicle designed for transporting goods from one location to another.

Q22: When an event's probability depends on the

Q33: A binomial distribution has 100 trials (n

Q44: An alternate hypothesis is a statement about

Q46: A frequency distribution has a mean of

Q55: The distribution of Student's t is _.<br>A)symmetrical<br>B)negatively

Q55: For a population that is not normally

Q57: Percentiles divide a distribution into 100 equal

Q77: The z-score or z-value corresponding to a

Q77: Giorgio offers the person who purchases an

Q78: Your favorite soccer team has two remaining