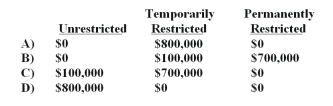

During the year ended June 30,2017,Hopkins College,a private college,received a federal government grant of $800,000 for research on the role of music in improving math skills for students.Expenses for this research amounted to $100,000 during the same year.Under FASB standards,which of the following best represents how Hopkins College would report this nonexchange transaction in the net assets section for the year ended June 30,2017?

Definitions:

Intrinsic Value Method

A method of valuing a company or its stock by determining the present value of its expected future earnings or cash flows, disregarding current market conditions.

Stock Appreciation Rights

A type of employee compensation linked to the increase in the price of the company's stock over a set period.

Performance-based

An approach or system where rewards, compensation, or progression are tied to the achievement of specific goals, outcomes, or the quality of work performed.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, representing the ownership interest of the shareholders.

Q7: Budget appropriations for governmental funds ordinarily cover

Q10: Record in general journal form the following

Q21: Which of the following accounts is least

Q25: Nongovernmental (private)colleges and universities should follow FASB

Q32: How would a private college or university

Q39: State educational appropriations received by a public

Q40: The following are key terms in Chapter

Q51: A nongovernmental tax-exempt organization must complete a

Q58: Unlike other not-for-profit entities,the FASB requires health

Q60: A private university following the recommendations of