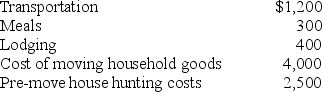

Due to a company consolidation,Rob transfers from Boston to San Diego.Under a new job description,he is reclassified from department manager to a staff member.His moving expenses,which are not reimbursed,are as follows:  Rob's deductible moving expense is:

Rob's deductible moving expense is:

Definitions:

Aggregate

A whole formed by combining several separate elements; often used in the context of data or materials.

Efficiency Metrics

Quantitative tools used to assess the productivity and performance of a system or process, focusing on maximizing outputs with minimal inputs.

Total Cost

The complete amount of money required to produce goods or services, including fixed and variable costs.

Ownership

The state or fact of exclusive rights and control over property, which can be an object, land/real estate, intellectual property, or some other kind of property.

Q7: Raul contributes the following assets to a

Q32: The governmental fund financial statements are intended

Q33: A corporation with a net capital gain

Q40: The governmental funds operating statement presents all

Q59: For AMT purposes,a taxpayer must use which

Q60: Corporate distributions to shareholders are called dividends.

Q63: Antonio reported the following itemized deductions on

Q73: Which of the following transactions is classified

Q85: Property tax revenue is an example of

Q87: What is usually the largest miscellaneous itemized