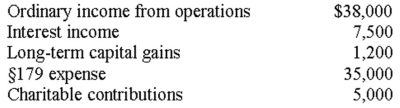

Marty and Blake are equal partners in MB Partnership.The partnership reports the following items of income and expense:  a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

b.Where (on what forms)will these amounts be reported by the partners?

Definitions:

Contribution Margin

The amount of revenue remaining after deducting variable costs, which can then be used to cover fixed costs and contribute to profit.

Product Mix

The variety of products that a company produces or sells, considering the diversity in type, size, and quality.

Prime Cost

The sum of direct materials and direct labor costs associated with the production of goods.

Manufacturing Overhead

Indirect costs associated with manufacturing, such as utilities, maintenance, and factory equipment depreciation, not directly tied to specific units of product.

Q25: Barbara and Michael (wife and husband)are itemizing

Q35: Maeda Company has the following employees on

Q40: Interperiod equity refers to the concept that

Q45: Jasmine sold land for $250,000 in 2014.The

Q58: Due to a company consolidation,Rob transfers from

Q66: Which of the following statements is incorrect?<br>A)

Q74: Which of the following is deductible as

Q81: Generally,tax-deferred retirement plans are not required to

Q100: The Frazins had adjusted gross income of

Q112: For 2014,describe the treatment that taxpayers can