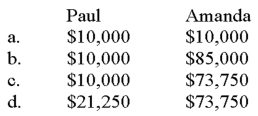

Paul invests $10,000 cash in an equipment leasing activity for a 15% ownership share in the business.The remaining 85% owner is Amanda.Amanda contributes $10,000 and personally borrows $75,000 that she also invests in the business.What are the at-risk amounts for Paul and Amanda?

Definitions:

Equitable Estoppel

A legal principle preventing someone from arguing something contrary to a claim if a previous action or agreement implied that claim.

Written Promise

A documented commitment by one party to perform or refrain from performing certain actions for another party.

Reasonable Amount

An amount that is considered fair, appropriate, and not excessive under the circumstances, often used in legal and financial contexts.

Gratuitous Promise

A pledge or commitment made without the expectation of receiving something in return, not typically enforceable as a contract.

Q22: If donated appreciated capital gain property is

Q27: In 2013,Angel contributes land to a partnership

Q28: Books purchased for courses at the campus

Q31: Which of the following expenses is not

Q50: Kyung formed a corporation and owns all

Q64: Edith owns farm land in western Montana.Her

Q75: For a taxpayer to be eligible to

Q84: For 2014,the AGI threshold for the deductibility

Q113: If the modified AGI of a married

Q118: Failure to furnish a correct TIN to