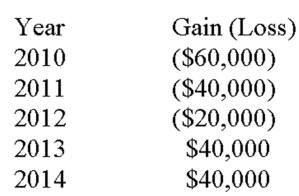

In 2010,Lindsay's at-risk amount was $50,000 at the beginning of the year.Lindsay's shares of income and losses from the activity were as follows (ignore passive loss rules):  In 2014,what amount of income or loss will Lindsay report from this activity?

In 2014,what amount of income or loss will Lindsay report from this activity?

Definitions:

Organizational Citizenship Behavior

Voluntary, extra-role actions performed by employees that contribute to the overall effectiveness and positive atmosphere of an organization.

Self-Esteem

An individual's subjective assessment of their own worth or value.

Happiness

A condition marked by happiness and satisfaction, featuring a range of positive feelings from general contentment to profound bliss.

Meaning

The significance or interpretation assigned to something, such as a word, symbol, gesture, or event.

Q7: Angie earned $120,000 during 2014.She is single,claims

Q10: Schedule M-1 reconciles from taxable income to

Q21: Brenda is a self-employed accountant.She has net

Q37: In order for a personal property tax

Q46: Kyle and Alyssa paid $1,000 and $2,000

Q51: The maximum adoption credit is 50% of

Q75: Guaranteed payments are the only items that

Q79: Guillermo and Felicia are married,file a joint

Q95: April and Joey are both 74 years

Q112: Enrique and Anna filed a joint tax