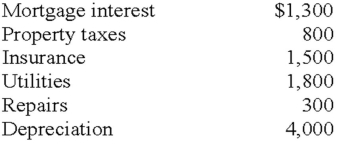

Jacqueline owns a condominium on an island in Washington which was rented out all year for $30,000.She incurred the following expenses:  What amount of net income or loss does Jacqueline report from this rental property?

What amount of net income or loss does Jacqueline report from this rental property?

Definitions:

Integrative

Pertaining to strategies or approaches that combine elements in order to create a unified whole, often used in context of conflict resolution to find mutually beneficial solutions.

Unilateral Choice

A decision made by one party without the consultation, agreement, or consent of others.

Active Involvement

Direct and energetic participation in a task or activity.

Claiming Value Strategies

Techniques used in negotiation focused on maximizing one's own benefit from the deal being negotiated.

Q15: Sandy is a self-employed health information coder.She

Q24: No deduction is allowed with respect to

Q43: Robert and Melissa own a home in

Q47: Section 1221 assets are any asset used

Q53: Form 941 is prepared by the employer

Q76: If Elliot,an accountant,agrees to provide tax services

Q105: Imputed interest rules apply to term loans

Q109: A de minimis benefit is one whose

Q112: The tax tables stop at taxable income

Q119: An employer who is a monthly schedule