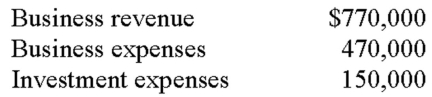

Alex,Ellen and Nicolas are equal partners in a local restaurant.The restaurant reports the following items for the current year:  Each partner receives a Schedule K-1 with one-third of the preceding items reported to him/her.How must each individual report these results on his/her Form 1040?

Each partner receives a Schedule K-1 with one-third of the preceding items reported to him/her.How must each individual report these results on his/her Form 1040?

Definitions:

Proposed Acquisition

A potential financial transaction where one company offers to purchase or merge with another entity.

Dividend Growth Model

A method for valuing a stock by assuming dividends grow at a constant rate indefinitely and calculating the present value of the forecasted dividends.

Annual Dividend

The yearly total amount of dividends a company distributes to its shareholders.

Quarterly Dividend

A distribution of a portion of a company's earnings, declared by the board of directors, to shareholders on a quarterly basis.

Q5: In July 2014,Cassie purchases equipment for $55,000

Q23: Tonia acquires the following 5-year class property

Q30: With OID instruments,taxpayers report annually a portion

Q38: Interest on state bonds is tax-exempt if

Q52: An employee who works for multiple employers

Q67: On December 28,2014,Misty sold 300 shares of

Q70: What is the amount of the social

Q100: From which of the following flow-through entities

Q118: A taxpayer purchased land in 2007 for

Q130: Taxpayers can claim a child tax credit