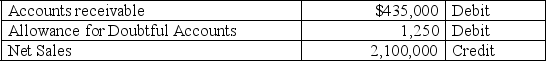

A company used the percent of sales method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts: All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Net Profit Margin

Net profit margin is a financial ratio that shows what percentage of a company's revenues remain as net income after all expenses are deducted.

Earnings Per Share

A financial ratio that measures the portion of a company’s profit allocated to each outstanding share of common stock, indicating company profitability.

Time Management

Making effective use of available time.

Planning

The process of setting goals, developing strategies, and outlining tasks and schedules to achieve the desired goals.

Q6: The net method for recording purchases records

Q36: A lawsuit is an example of a

Q39: The following account balances are taken from

Q45: Williams Company began business on May 1.They

Q55: If a check correctly written and paid

Q96: The percent of sales method of estimating

Q109: The Sun Company completed the following sales

Q150: The payroll records of a company provided

Q179: When a voucher system is used,recording a

Q184: It is not necessary for businesses to