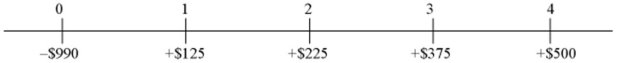

Consider a project of the Cornell Haul Moving Company,the timing and size of the incremental after-tax cash flows (for an all-equity firm) are shown below in millions:  The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of this project to an all-equity firm?

The firm's tax rate is 34 percent; the firm's bonds trade with a yield to maturity of 8 percent; the current and target debt-equity ratio is 3; if the firm were financed entirely with equity,the required return would be 10 percent. Using the APV method,what is the value of this project to an all-equity firm?

Definitions:

Present Value Concepts

Financial principles used to determine the current value of future cash flows, taking into account specific rates of return or discount rates.

Net Cash Flows

The difference between a company's cash inflows and outflows within a defined period.

Annuity

A financial instrument that provides a consistent flow of payments to a person, mainly serving as a source of income for people in retirement.

Equal Cash Flow

A scenario in which cash inflows or outflows are the same in each period.

Q1: With regard to estimates of "world beta"

Q12: What interest rate is required to accumulate

Q14: The idea that the tax burden a

Q16: The parent company should decide the financing

Q22: Only in the 1990s did world investors

Q55: The key factors that are important in

Q56: Tiger Towers,Inc.is considering an expansion of

Q57: Consider a U.S.MNC with three subsidiaries and

Q67: Consider a project of the Cornell Haul

Q91: The term "capital-import neutrality" refers to<br>A)the criterion