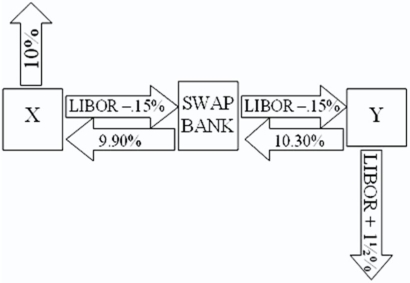

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown here: A swap bank proposes the following interest only swap:

X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR ? 0.15 percent; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90 percent.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR ? 0.15 percent.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Efficacy

The ability of a product or treatment to produce a desired effect under ideal and controlled conditions.

Placebos

Inactive substances or treatments used in controlled experiments to test the efficacy of therapeutic interventions, serving as a control group to the active treatments.

Headache Monitoring

The systematic tracking of headache occurrence, intensity, and duration to aid in diagnosis and treatment planning.

Relaxation Therapies

Techniques or practices designed to reduce stress and anxiety, thereby promoting physical and mental well-being; examples include meditation, deep-breathing exercises, and progressive muscle relaxation.

Q6: Your firm's inter-affiliate cash receipts and

Q8: Since fixed assets and inventory are usually

Q12: ABC Trading Company of Singapore purchases

Q29: Consider a project of the Cornell Haul

Q47: A is a U.S.-based MNC with

Q62: A type of non-continuous exchange trading system

Q63: Consider the following international investment opportunity.It involves

Q80: The underlying principle of the temporal method

Q92: A measure of "liquidity" for a stock

Q96: One lesson from the credit crunch is