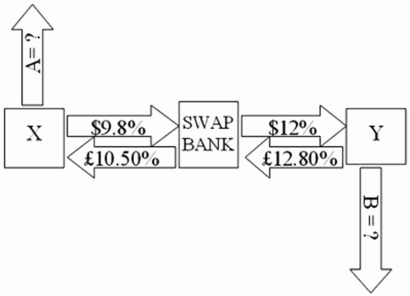

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are: A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80 percent; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5 percent.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12 percent.  If company X takes on the swap,what external actions should they engage in?

If company X takes on the swap,what external actions should they engage in?

Definitions:

Tunneling

The creation of narrow passageways through or under an obstacle, often used in the context of engineering or computing.

Abdominal Binder

A medical garment that wraps around the abdomen to provide support and compression, often used after surgery or childbirth.

Pulse Oximetry

A non-invasive method to measure oxygen saturation levels in the blood, typically using a clip-like device attached to a finger.

Elastic Bandage

A stretchable bandage used to create localized pressure, often used in first aid to reduce swelling and support strains or sprains.

Q4: Suppose the U.S.dollar substantially depreciates against the

Q9: Assuming that the bond sells at par,the

Q9: Consider the situation of firm A

Q10: If a foreign entity is only a

Q27: A highly inflationary economy is defined in

Q30: Your firm's inter-affiliate cash receipts and

Q42: A bank may establish a multinational operation

Q49: At the optimal capital structure,<br>A)K = (1

Q72: Not all countries allow MNCs the freedom

Q84: Consider a project of the Cornell Haul