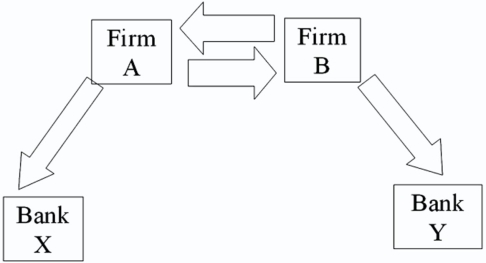

Consider the situation of firm A and firm B.The current exchange rate is $2.00/£ Firm A is a U.S.MNC and wants to borrow £30 million for 2 years.Firm B is a British MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown,both firms have AAA credit ratings.

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.

Definitions:

Constant Returns To Scale

a situation in production where increasing all inputs by the same percentage results in output increasing by that same percentage.

Long-run Profits

The potential earnings of a business over a period long enough for all inputs to be adjusted, considering the firm's ability to enter or exit markets.

Factor Price

The price at which factors of production (land, labor, capital) are bought and sold.

Production Function

A mathematical model that describes the relationship between inputs used in production and the resulting output.

Q19: With regard to clearing procedures for bond

Q19: Changes in exchange rates<br>A)explain a larger portion

Q20: Compute the debt-to-total-value ratio for a firm

Q35: Use the following information to calculate

Q66: Whether or not cross-border acquisitions produce synergistic

Q80: The underlying principle of the temporal method

Q82: Which combination of the following represent the

Q87: In a dealer market,the broker takes the

Q88: Banking tends to be<br>A)a low marginal cost

Q91: "Call market" and "crowd trading" take place