Consider the situation of firm A and firm B.The current exchange rate is $2.00/£ Firm A is a U.S.MNC and wants to borrow £30 million for 2 years.Firm B is a British MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown,both firms have AAA credit ratings.

The IRP 1-year and 2-year forward exchange rates are ($ ∣ £)= = ($ ∣ £)= = USD pounds

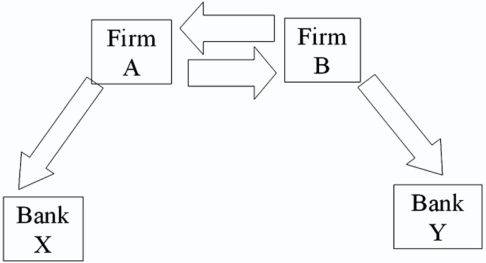

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.Answer the problem in the template provided

Definitions:

Population Variances

A measure of the spread of a population's values, indicating how much the members of the population differ from the population mean.

Population Means

The average value of a set of characteristics within a total population.

Sample Means

Refers to the average values computed from multiple samples from a population, usually to estimate the population mean.

Pooled Variance

combines the variances of two or more groups, assuming they have the same underlying variance, to estimate a common variance.

Q6: The "reporting currency" is defined in FASB

Q10: Find the present value of a 3-year

Q12: The ABC Company,a U.S.-based MNC,plans to establish

Q30: i = r<sub>debt</sub> = 10% OCF<sub>0</sub> =

Q33: The underlying principle of the current/noncurrent method

Q37: The required return on equity for a

Q78: Decompose the return an American would have

Q81: A flexible sourcing policy<br>A)is primarily concerned with

Q92: One likely effect of a company or

Q93: Consider a U.S.-based MNC with a wholly-owned