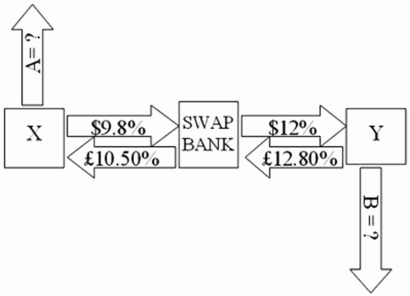

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are: A swap bank proposes the following interest-only swap: Company X will pay the swap bank annual payments on $10,000,000 at an interest rate of $9.80 percent; in exchange the swap bank will pay to company X interest payments on £5,000,000 at a fixed rate of 10.5 percent.Y will pay the swap bank interest payments on £5,000,000 at a fixed rate of 12.80 percent and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of 12 percent.  If company X takes on the swap,what external actions should they engage in?

If company X takes on the swap,what external actions should they engage in?

Definitions:

Federal Funding

Financial support from the federal government to support a wide range of projects, from infrastructure to research and social programs.

Employment

Employment refers to the condition of having paid work, the process of hiring someone for a job, or the relationship between an employer and their employees.

Homeless Shelter

A place providing temporary accommodation to people without homes.

Supported Employment

A program designed to help people with disabilities find and maintain gainful employment with necessary support services.

Q6: The record of investing in U.S.-based stock

Q9: Some countries allow inter-affiliate transactions to be

Q19: The United States is the largest initiator,of

Q42: There are two types of equity related

Q52: The U.S.IRS allows transfer prices to be

Q68: A bank may establish a multinational operation

Q84: Company X wants to borrow $10,000,000

Q92: A U.S.firm holds an asset in

Q93: If the investor hedges the exchange rate

Q97: In the real world,does the cost of