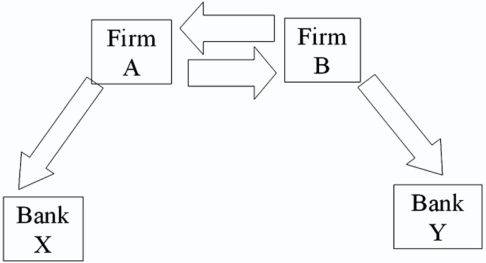

Consider the situation of firm A and firm B.The current exchange rate is $2.00/£ Firm A is a U.S.MNC and wants to borrow £30 million for 2 years.Firm B is a British MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown,both firms have AAA credit ratings.

The IRP 1-year and 2-year forward exchange rates are ($ ∣ £)= = ($ ∣ £)= = USD pounds

Devise a direct swap for A and B that has no swap bank.Show their external borrowing.Answer the problem in the template provided

Definitions:

Compliance

The act of conforming to rules, standards, or instructions, often in a legal, ethical, or organizational context.

Resistance

Opposition or pushback against proposals, changes, or directives perceived as unwanted or detrimental.

Exchange Tactic

is a strategy in negotiations where something is offered in return for something from the other party.

Reward

Benefits, compensation, or recognition given to individuals or groups as recognition for their efforts, achievements, or behavior.

Q12: A zero-coupon British bond promises to pay

Q26: In a study of the effect of

Q40: The withholding tax on bond income was

Q43: Come up with a swap (exchange

Q45: Solnik (1984)examined the effect of exchange rate

Q49: What is the objective of managing operating

Q53: Hedge fund advisors typically receive a management

Q65: The exchange markets in the U.S.are<br>A)agency markets.<br>B)auction

Q72: Emerald Energy is an oil exploration and

Q94: The link between a firm's future operating