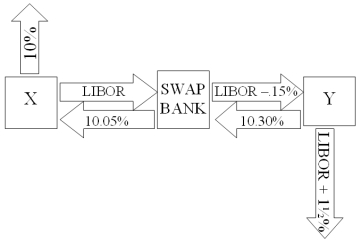

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are shown below: A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 10.05%.Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Clinical Decision Support

A health information technology system that provides clinicians, staff, and patients with knowledge and person-specific information, intelligently filtered and presented at appropriate times, to enhance health and healthcare.

Specialty

A particular branch of medicine or surgery in which a doctor has undergone advanced training and gained expertise.

Objective Finding

A measurable or observable fact or symptom in a patient, discernible through diagnostic tests or physical examination.

HPIP System

High-Performance Incentive Program, a strategy designed to improve efficiency and outcomes through incentives.

Q5: The owners of a business are the<br>A)taxpayers.<br>B)workers.<br>C)suppliers.<br>D)shareholders.

Q5: A major risk faced by a swap

Q9: Unlike the theory of international trade or

Q13: Public traders do not trade directly with

Q24: While there is no comprehensive theory of

Q53: A DECREASE in the implied three-month LIBOR

Q73: Suppose that the British stock market is

Q75: What is the dollar-denominated IRR of this

Q89: Using the weighted average cost of capital

Q93: The rapid increase in cross-border M&A deals