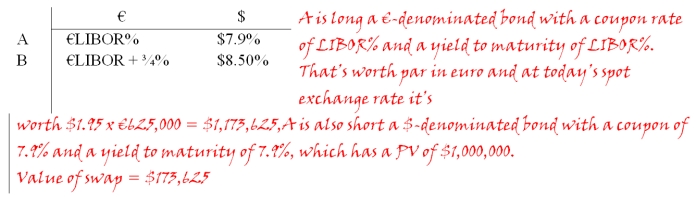

Suppose that the swap that you proposed in question 2 is now 4 years old (i.e.there is exactly one year to go on the swap).If the spot exchange rate prevailing in year 4 is $1.8778 = €1 and the 1-year forward exchange rate prevailing in year 4 is $1.95 = €1,what is the value of the swap to the party paying dollars? If the swap were initiated today the correct rates would be as shown:  Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Definitions:

Advertisement

A public promotion of a product, service, or event through various forms of media.

Breach of Contract

The inability to fulfill any condition or duty stipulated in a contract, agreement, or obligation due to the absence of a valid legal justification.

Enforceable

Capable of being executed or imposed as per law or agreement.

Verbal Offer

An offer made in spoken form rather than in writing, which may be binding depending on the context and jurisdiction.

Q4: Using your results to the last question,make

Q6: In the notation of the book,K

Q11: Find the net cash flow for the

Q12: The spot exchange rate is ¥125 =

Q15: Under FASB 52,when a net translation exposure

Q33: A 1-year,4 percent pound denominated bond sells

Q41: Solve for the weighted average cost

Q44: LIBOR<br>A)is a market rate, analogous to the

Q71: A major risk faced by a swap

Q72: Solve for the weighted average cost