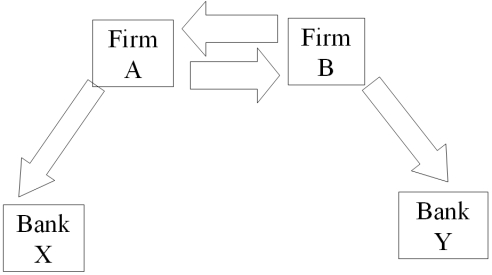

Consider the situation of firm A and firm B. The current exchange rate is $2.00/£. Firm A is a U.S. MNC and wants to borrow £30 million for 2 years. Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings. The IRP 1-year and 2-year forward exchange rates are

-Devise a direct swap for A and B that has no swap bank.Show their external borrowing.Answer the problem in the template provided.

Definitions:

Q5: What is the levered after-tax incremental cash

Q5: Find the weighted average cost of capital

Q8: Find the euro-zone cost of capital to

Q10: When using the current/noncurrent method,current assets are

Q13: Suppose you are a euro-based investor who

Q21: A "three against nine" forward rate agreement<br>A)could

Q50: A swap bank<br>A)can act as a broker,

Q91: International markets for goods and services are

Q93: Emerald Energy is an oil exploration and

Q95: Whether or not cross-border acquisitions produce synergistic