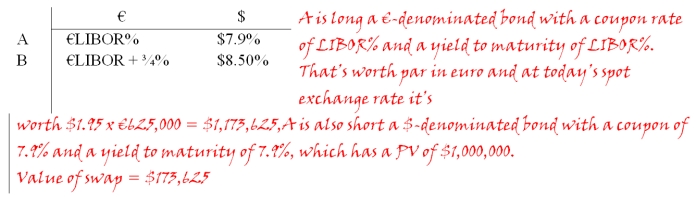

Suppose that the swap that you proposed in question 2 is now 4 years old (i.e.there is exactly one year to go on the swap).If the spot exchange rate prevailing in year 4 is $1.8778 = €1 and the 1-year forward exchange rate prevailing in year 4 is $1.95 = €1,what is the value of the swap to the party paying dollars? If the swap were initiated today the correct rates would be as shown:  Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Consider the situation of firm A and firm B.The current exchange rate is $1.50/€.Firm A is a U.S.MNC and wants to borrow €40 million for 2 years.Firm B is a French MNC and wants to borrow $60 million for 2 years.Their borrowing opportunities are as shown; both firms have AAA credit ratings.

Definitions:

Economic Recession

A period of temporary economic decline during which trade and industrial activities are reduced, generally identified by a fall in GDP in two successive quarters.

Inflation

The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

Random Variation

The variability in data that arises due to chance and cannot be attributed to any specific cause or pattern.

Stock Market Prices

The current price at which shares of a company are bought and sold in the stock market.

Q7: A swap bank makes the following quotes

Q10: What is the price of beer without

Q19: What major dimension sets apart international finance

Q25: In terms of the types of instruments

Q30: "Investment grade" ratings are in the following

Q38: Using your results to the last question,use

Q54: Find the price of a 30-year zero

Q62: Privatization refers to the process of<br>A)having government

Q75: A type of noncontinuous exchange trading system

Q81: The simplest of all translation methods to