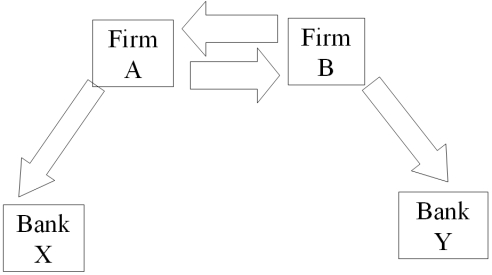

Consider the situation of firm A and firm B. The current exchange rate is $2.00/£. Firm A is a U.S. MNC and wants to borrow £30 million for 2 years. Firm B is a British MNC and wants to borrow $60 million for 2 years. Their borrowing opportunities are as shown, both firms have AAA credit ratings. The IRP 1-year and 2-year forward exchange rates are

-Devise a direct swap for A and B that has no swap bank.Show their external borrowing.Answer the problem in the template provided.

Definitions:

Periodic Replenishment

Periodic Replenishment refers to the inventory management practice of ordering or producing goods at regular intervals, regardless of the inventory levels.

Continuous Review

A system of managing inventory where the stock levels are continuously monitored, with orders placed as soon as inventory drops to a predetermined level.

Safety Inventory

A quantity of stock kept on hand to prevent stockouts due to variability in supply or demand.

Product Availability

The extent to which a product can be purchased at any given time and location.

Q5: Currently,the biggest bank in the world is<br>A)Citigroup.<br>B)Bank

Q8: Solve for the weighted average cost

Q27: Solve for the weighted average cost

Q30: Systematic risk is<br>A)nondiversifiable risk.<br>B)the risk that remains

Q43: When evaluating a foreign investment project,it is

Q44: The underlying principle of the current/noncurrent method

Q53: A DECREASE in the implied three-month LIBOR

Q88: The models that the credit rating firms

Q94: What is the dollar-denominated IRR of this

Q96: Bonds with equity warrants<br>A)are really the same