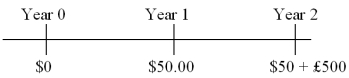

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

Definitions:

Corporate Strategy

The approach and actions a company takes to achieve its business goals and to secure a competitive position in the market.

IT Steering Committee

A group of senior executives who provide direction, guidance, and oversight for an organization's IT strategies, policies, and investments.

Top-Level IT Managers

Senior executives responsible for overseeing the information technology strategies and operations within an organization.

Functional Area Managers

Managers responsible for specific departments within a company, such as sales, marketing, or finance, focusing on specialized tasks and strategies.

Q2: The OTC market<br>A)does not accept credit-the dealers

Q3: Calculate the cumulative translation adjustment for this

Q4: ADRs<br>A)frequently represent a multiple of the underlying

Q14: Which of the following terms best describes

Q33: Under the monetary/nonmonetary method,revenue and expense items

Q35: In highly inflationary economies,FASB 52 requires that

Q40: Consider a British pound-U.S.dollar dual currency bonds

Q49: Proceeding the Asian crisis,<br>A)bankers from industrialized countries

Q65: Which of the following is NOT an

Q66: In the London market,Rolls-Royce stock closed at