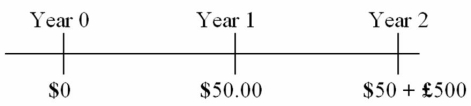

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Purely Competitive Industry

A market structure characterized by many small firms producing identical products where no single firm can influence the market price.

AVC Curve

A graph that illustrates the average variable costs associated with producing different quantities of output, typically showing a U-shaped curve due to economies and diseconomies of scale.

MC Curves

Marginal cost curves, which represent the change in total cost that arises when the quantity produced is incremented by one unit.

Total Fixed Costs

Costs that do not vary with the level of output or sales in the short term, including expenses such as rent, salaries, and insurance.

Q2: Calculate the euro-based return an Italian investor

Q7: Synergistic gains<br>A)are obtained when the acquiring firm

Q18: Consider the balance sheets of Bank A

Q20: The SPIN approach has four interrelated parts;

Q36: The record of investing in U.S.-based international

Q45: With regard to dual-currency bonds versus comparable

Q50: With regard to the financial structure of

Q51: If you sell a product,chances are you

Q64: The Toronto Stock exchange<br>A)is fully automated.<br>B)features electronic

Q68: In order to make the sale,it is