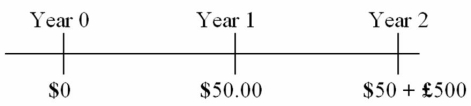

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

Definitions:

Auditory Discrimination

The ability to recognize differences between sounds, crucial for language development and understanding.

Brain's Plasticity

The ability of the brain to change and adapt in structure and function in response to experience and new learning.

Teratogens

Agents or factors that can cause malformation of an embryo or fetus, including certain drugs, illnesses, and environmental exposures.

Rejects Foods

The act of refusing to eat specific food items, commonly observed in children but can occur at any age due to preferences, allergies, or other reasons.

Q3: Deregulated financial markets and heightened competition in

Q27: "Can you imagine your sales force using

Q33: Under the monetary/nonmonetary method,revenue and expense items

Q50: "Yankee" bonds are<br>A)dollar-denominated foreign bonds originally sold

Q58: What is the relative price of wheat

Q61: Some of the risks that a swap

Q71: The SPIN approach uses a series of

Q75: A type of noncontinuous exchange trading system

Q83: A is a U.S.-based MNC with

Q93: Emerald Energy is an oil exploration and